With great pleasure, we will explore the intriguing topic related to Tax Brackets After 2025: A Comprehensive Overview. Let’s weave interesting information and offer fresh perspectives to the readers.

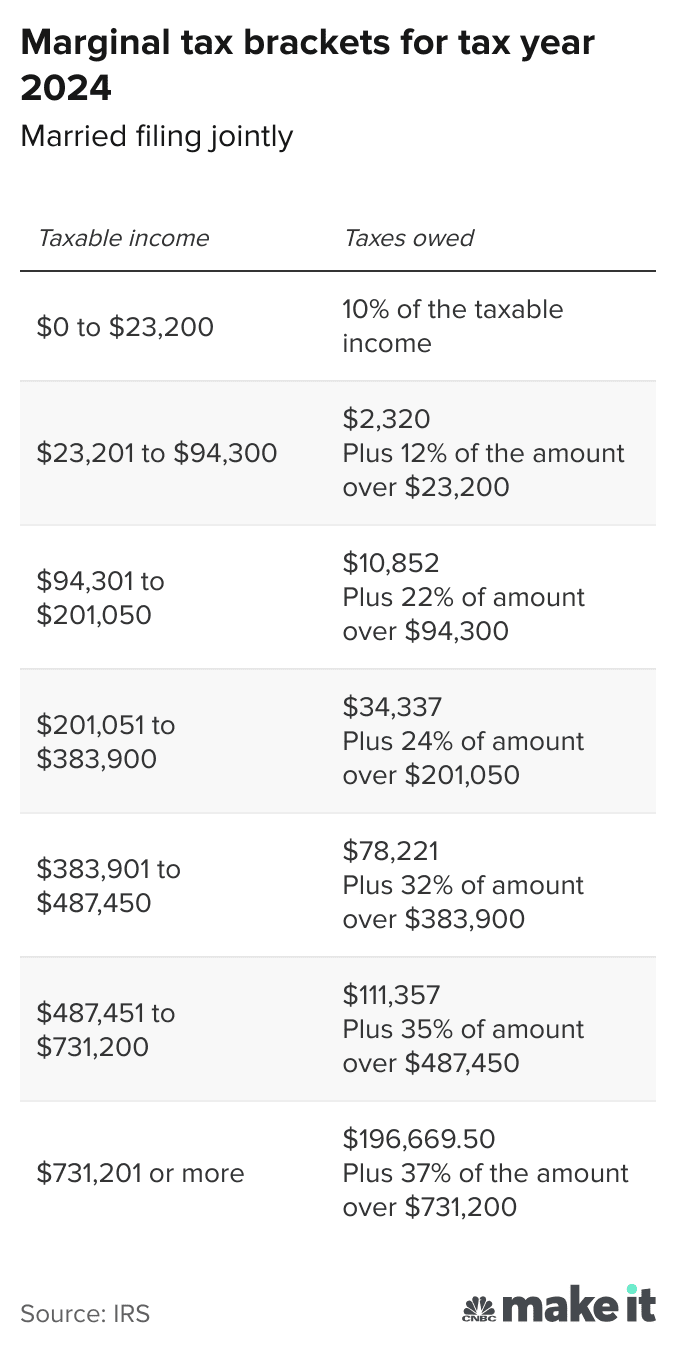

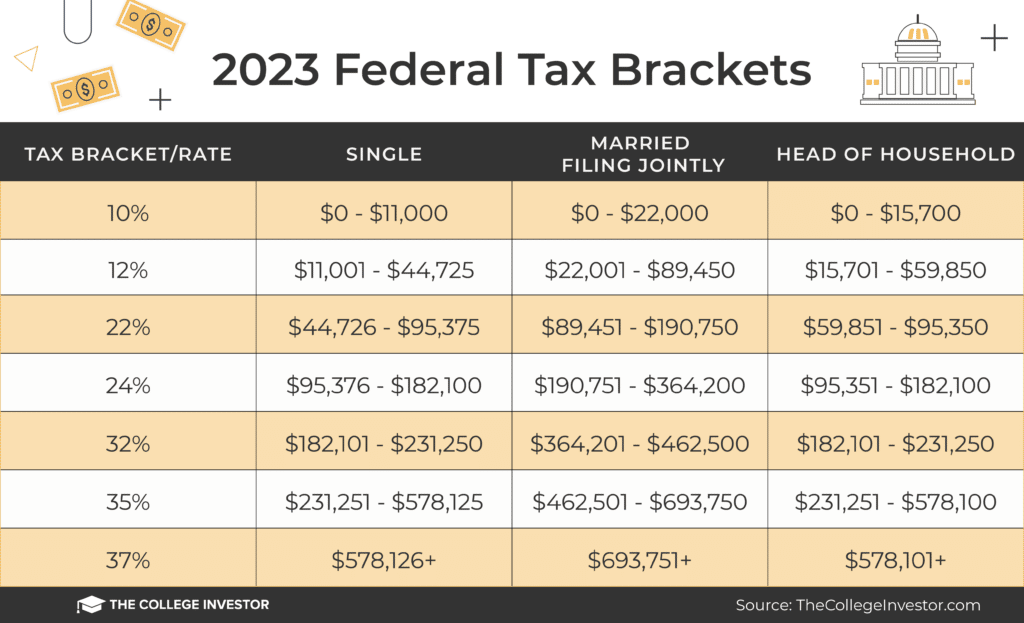

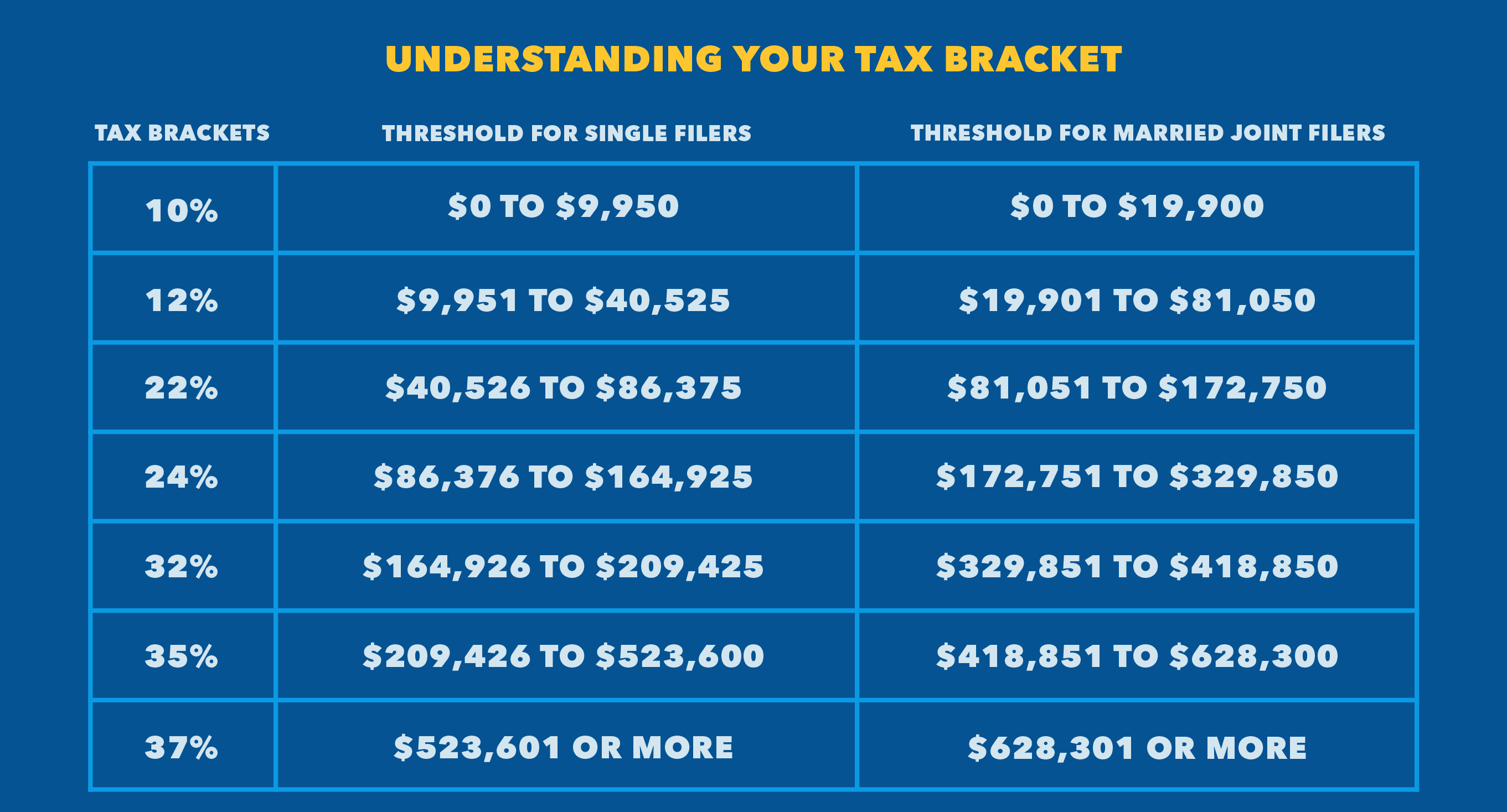

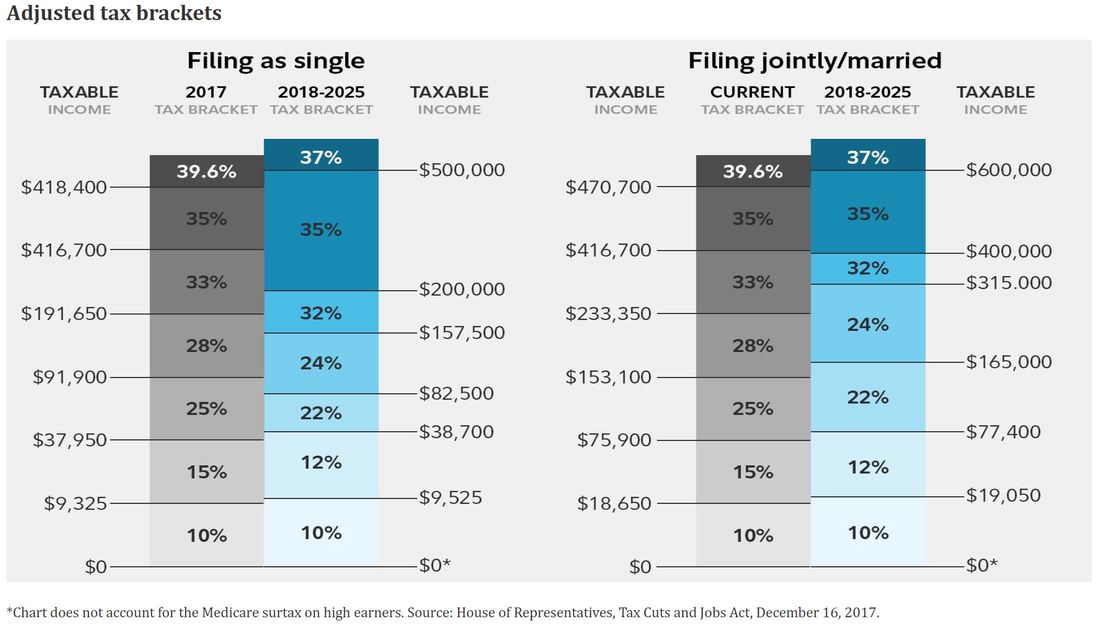

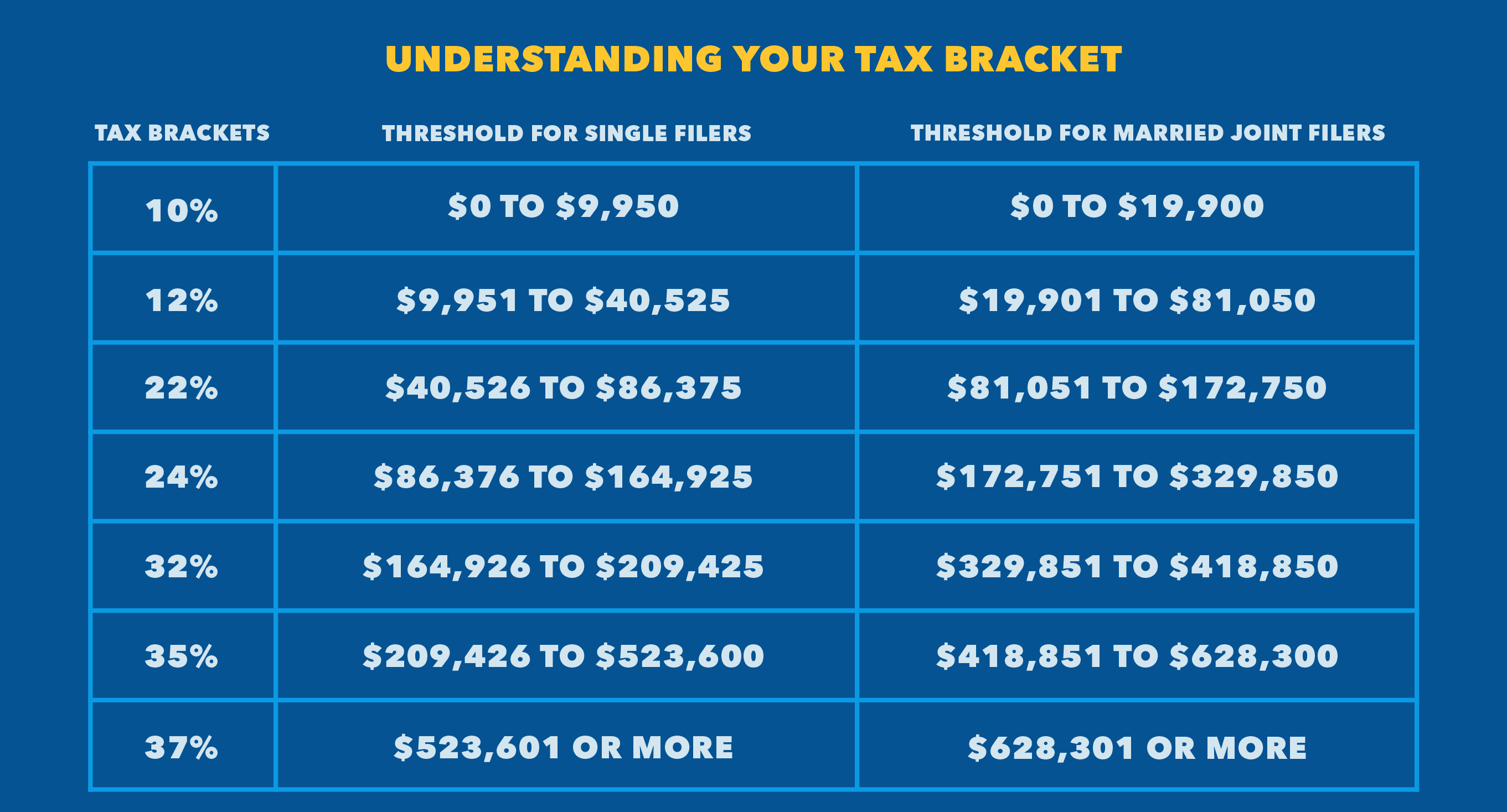

The tax brackets in the United States are the ranges of taxable income that are subject to different tax rates. These brackets are adjusted annually for inflation, and they play a crucial role in determining how much income tax individuals and businesses owe. The tax brackets for 2025 and 2025 have already been announced, but there is still uncertainty about what the tax brackets will look like after 2025.

For the 2025 tax year, the tax brackets for individuals will be adjusted for inflation. The exact amounts of the brackets have not yet been announced, but they are expected to be slightly higher than the 2025 brackets.

The tax brackets for 2025 and beyond have not yet been announced, and there is some uncertainty about what they will look like. However, there are a few possible scenarios that could play out.

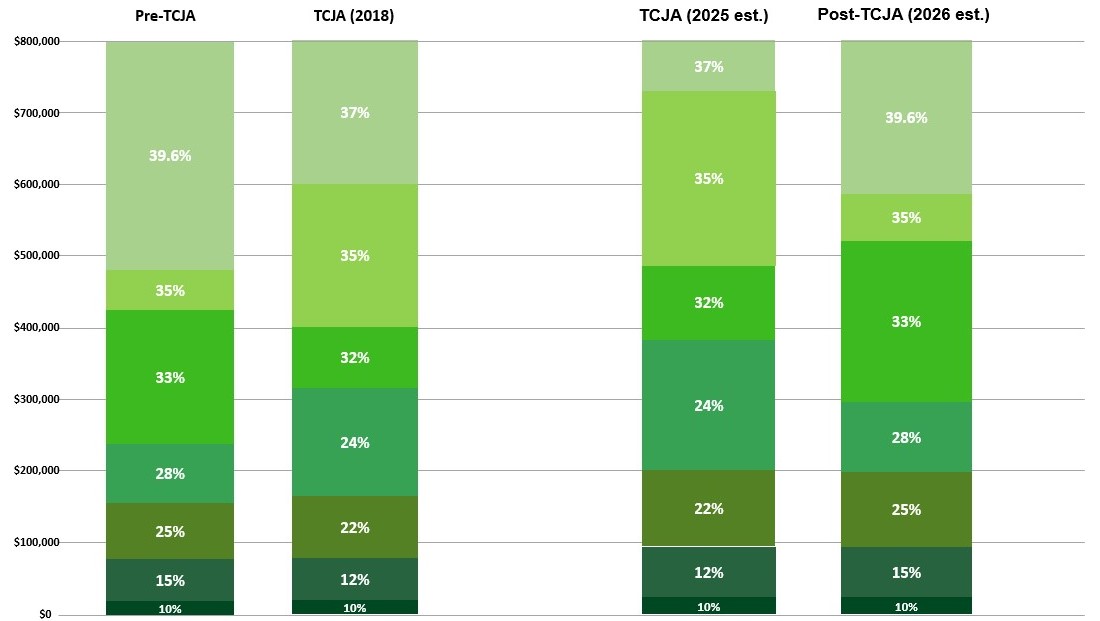

One possibility is that the tax brackets will remain relatively stable after 2025. This means that the income ranges for each bracket would not change significantly, and the tax rates would remain the same.

Another possibility is that the tax brackets will be expanded. This means that the income ranges for each bracket would be increased, and the tax rates would be lowered. This would result in lower taxes for individuals and businesses.

A third possibility is that the tax brackets will be compressed. This means that the income ranges for each bracket would be decreased, and the tax rates would be increased. This would result in higher taxes for individuals and businesses.

The tax brackets have a significant impact on individuals and businesses. The brackets determine how much income tax individuals and businesses owe, and they can also affect investment decisions and economic growth.

If the tax brackets are expanded, it would result in lower taxes for individuals and businesses. This would increase disposable income and stimulate economic growth. However, it would also increase the federal budget deficit.

If the tax brackets are compressed, it would result in higher taxes for individuals and businesses. This would reduce disposable income and slow economic growth. However, it would also reduce the federal budget deficit.

The tax brackets for 2025 and beyond are still uncertain. However, there are a number of factors that will affect the brackets, including the rate of inflation, the economic outlook, the political climate, and the federal budget deficit. The brackets will have a significant impact on individuals and businesses, and they will play a key role in shaping the future of the U.S. economy.

Thus, we hope this article has provided valuable insights into Tax Brackets After 2025: A Comprehensive Overview. We appreciate your attention to our article. See you in our next article!